New data expose mysterious world of off-exchange health plans

By Harris Meyer

October 24, 2016 - Modern Healthcare

Average premiums

and deductibles for individual and small-group health plans on the Affordable

Care Act exchanges in 2016 were nearly 13% cheaper than for plans sold off the

exchanges, according to new

data from the Robert Wood Johnson Foundation.

The data set, compiled

from information purchased from Vericred, a New York City-based data company

serving the health insurance industry, provides the most detailed look yet at

how the ACA marketplace compares with the off-exchange market, about which much

less is known. HHS recently estimated that 6.9 million Americans have

individual-market plans they bought outside the ACA exchanges, compared with

10.4 million who have exchange plans. Most off-exchange plans have to comply

with the same ACA benefit and guaranteed issue rules as exchange plans.

The data could help policymakers, insurers, researchers and consumers

better understand the full range of options available in the individual and

small-group markets. It also could assist federal and state policymakers

stabilize the struggling Obamacare individual markets, which are experiencing

rising premiums, exiting insurers, and decreasing competition and consumer

choice.

The average silver plan premium on the exchanges across the country was $279

versus $314 for similar plans sold off the exchanges. In the individual

insurance market alone, the average rate for a silver plan for a 27-year-old on

the exchanges was $283 versus $320 off the exchanges. The rate differences could

result from a number of factors, including network size and deductible and

cost-sharing levels.

In the individual exchange market, silver plans

were by far the most common type of product offered—64.9% versus 16.2% bronze

and 12.3% gold. There was greater variety off the exchanges, where 33.7% of

plans offered were silver, 33.1% were bronze, and 21.6% were gold.

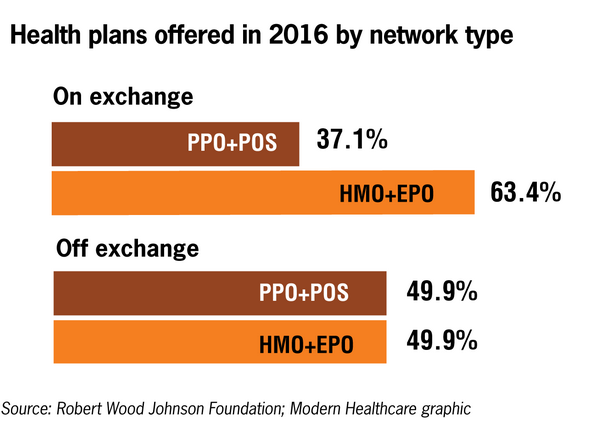

There

also were significant differences in network types offered on and off the

exchanges in 2016, according to the RWJF data. HMO and exclusive provider

organization (EPO) products were far and away the most common products on the

exchanges, making up 63.4% of plans offered compared with 37.1% for preferred

provider organization (PPO) and point-of-service (POS) plans. Off the exchanges,

PPO and POS plans were more common, making up 49.9% of plans offered, the same

percentage as HMO and EPO plans.

Katherine Hempstead, who directs the Robert Wood Johnson Foundation's work on

health coverage, said the data will prove valuable in helping everyone think

about the individual market as a whole. gIt's important for us to understand how

the off-exchange market helps or hinders the exchange market, and whether any

improvement is feasible to organize the two components and make it easier for

consumers to see what's available,h she said.

A number of insurers such

as Aetna are exiting the exchanges in some states while continuing to sell

off-exchange products in those same markets. An Aetna spokesman declined to

discuss details of the company's off-exchange business. But he said Aetna is

maintaining an off-exchange presence to preserve its option under federal law to

re-enter the exchange markets after 2017 gshould there be meaningful

exchange-related policy improvements.h

A Commonwealth

Fund study in June projected that insurers selling only off the exchanges in

2016 spent more on administration and profits and had higher premium increases

compared with insurers that sell mostly on the exchanges.

The new RWJF

data set includes comprehensive information on all individual and small-group

plans offered nationally, including carrier, location, premium, metal tier, type

of plan, and deductible and copayment levels. But it does not include

information on number of plans sold or any information about the people buying

these plans, such as age, income, or health status. While some observers have

speculated that people buying coverage outside the exchanges are healthier and

wealthier than exchange customers, the data don't answer such

questions.

gI hear insurers say the markets are more similar than

different, and I think insurers have lost money in the off-exchange market,h

Hempstead said.

Experts say there are a variety of reasons why consumers

buy coverage outside the exchanges, where they cannot receive an ACA premium

subsidy or cost-sharing reduction. The Obama administration and many experts say

most people in the individual market would be better off buying coverage on the

exchanges because most qualify for subsidies. In contrast, some conservative

analysts favor allowing premium subsidies for coverage purchased outside the

exchanges.

One reason some consumers go off the exchanges is that they

find it simpler to buy a plan directly from an insurer or through a broker if

they think they don't qualify for a subsidy. gIt's easier to move through the

process off the exchange, so convenience is a factor,h said Joel Ario, managing

director of Manatt Health Solutions, who helped establish the federal exchange

as an Obama administration official.

Some customers avoid the exchanges

because they are politically opposed to Obamacare, said Nate Purpura, vice

president of communications for ehealth, an online broker. About half the

261,000 individual plans ehealth sold from October through March were through

the exchanges and about half were off the exchanges.

Consumers looking

for a broader provider network or access to their regular physician or hospital

may have an easier time finding such a plan off the exchange, since PPO and POS

plans are more prevalent outside the exchanges, Hempstead said. Some may be

relatively affluent people who are buying coverage for adult children or other

family members with disabilities or chronic conditions and who want a plan that

gives them access to specialized providers.

Then there are lower-income

consumers who don't realize they can only obtain a premium tax credit through

the ACA exchanges and unwittingly forego that opportunity by buying an

off-exchange plan. HHS estimated this month that 2.5 million consumers who

bought plans off the exchange would be eligible for a subsidy. That includes 1.1

million people with incomes below 250% of the federal poverty level, which

qualifies them for additional cost-sharing subsidies. Another 1.9 million people

who bought off-exchange plans have incomes low enough to qualify for Medicaid.On

top of that, only 52% of uninsured adults were even aware that financial

assistance is available through the ACA exchanges, a recent Commonwealth Fund

survey found. gThere's a huge question about the information status of people

buying off the exchanges,h said Tim Jost, an emeritus law professor at

Washington and Lee University who is an ACA expert.

In addition, Jost

added, some brokers may be steering customers to off-exchange plans because

those plans are more likely to pay a broker fee than exchange plans, which

increasingly do not.

Middle-class consumers who don't qualify for

subsidies may buy outside the exchanges because they are misled or confused.

Michael Anderson, a retired police officer in Scottsdale, Ariz., said he went on

what he thought was the HealthCare.gov federal website to shop for exchange

coverage after he recently retired. But he apparently clicked on copycat

commercial site and got inundated with bogus offers. He ended up buying a

private off-exchange plan through ehealth. The premium, however, is going up

sharply for 2017. So he intends to visit the real HealthCare.gov site in

November to see what's available for him and his wife.

gIt was the first

time I was buying health insurance on my own, and the whole process was very

frustrating,h Anderson said.

Some experts favor merging the exchange and

off-exchange individual markets—which Vermont and Washington, D.C. already have

done—to help stabilize the ACA marketplaces and make it easier for consumers to

shop and compare premiums, benefits and provider networks across all available

individual-market products. Insurers strongly oppose this approach.

gIf

you set up an environment where customers get to compare all prices and products

in one place, that creates true competition and means better prices, and it can

actually reward insurers that provide the best products,h said Mila Kofman,

executive director of the D.C. exchange.

Ario said the new RWJF data

raise more questions than they answer about what's happening in the murky

off-exchange market and how it affects the ACA exchanges. Much more needs to be

known to guide policy and improve the functioning of the entire individual

market, and the data set is a good start.

gUltimately, it's good for

people to have lots of choices for subsidized and unsubsidized products,h he

said. gConsumers should have the same level of transparency about both markets.h